All posts tagged BOV

BOV CELEBRATES DOUBLE ACHIEVEMENT AT PREMJU NAZZJONALI ĦADDIEM TAS-SENA 2025

December 3, 2025 | No comments

BOV CELEBRATES DOUBLE ACHIEVEMENT AT PREMJU NAZZJONALI ĦADDIEM TAS-SENA 2025

Read more »

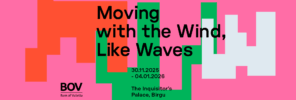

MOVING WITH THE WIND, LIKE WAVES

November 22, 2025 | No comments

Bank of Valletta and curator Elyse Tonna are pleased to announce the opening of Moving with the Wind, Like Waves on Sunday 30th November (18:00-21:00hrs), a site-specific contemporary art project unfolding through an exhibition, public programme and publication at the Inquisitor’s Palace, in Birgu.

Read more »

COLOUR, ENERGY AND COMMUNITY SPIRIT AT THIS YEAR’S COLOUR MY RUN

November 22, 2025 | No comments

Bank of Valletta proudly supported this year’s Colour My Run, which brought together families, colleagues and friends for a vibrant morning dedicated to movement and fun.

Read more »

BANK OF VALLETTA HOSTS FIRST INVESTOR DAYS

November 16, 2025 | No comments

Bank of Valletta (BOV) has hosted its first Investor Days in Malta, welcoming shareholders, customers, and financial community stakeholders to a discussion on the Bank’s performance, strategy and capital plans.

Read more »

BANK OF VALLETTA SHOWCASES INNOVATION AT 2025 CX CONFERENCE

November 16, 2025 | No comments

BANK OF VALLETTA SHOWCASES INNOVATION AT 2025 CX CONFERENCE

Read more »

GIUSEPPE CALI’S APSIDAL PAINTING AT SACRO CUOR IN SLIEMA RESTORED

November 16, 2025 | No comments

A few weeks ago, Bank of Valletta joined the Parish of Sacro Cuor, Sliema, to inaugurate the restoration of The Triumph of the Immaculate Conception, the dramatic apsidal painting by renowned Maltese artist Giuseppe Calì (1846–1930).

Read more »

BOV EXPANDS PRODUCT SUITE WITH GENERAL INSURANCE SOLUTIONS

November 4, 2025 | No comments

Bank of Valletta today announced its entry into the general insurance market and is extending its product and service suite through the distribution of some of MAPFRE Middlesea Insurance’s general insurance products.

Read more »

BOV MARKS GLOBAL ETHICS DAY 2025 WITH A CALL TO RE-THINK ETHICS IN THE DIGITAL AGE

October 23, 2025 | No comments

Bank of Valletta (BOV) proudly joined the global community in celebrating Global Ethics Day 2025, reaffirming its commitment to integrity and ethical leadership across the financial sector.

Read more »

BOV ANNOUNCES ISSUE OF UP TO €325 MILLION UNSECURED EURO MEDIUM TERM BONDS

October 23, 2025 | No comments

Bank of Valletta has just received regulatory approval from the Malta Financial Services Authority (MFSA) for the listing of an Unsecured Euro Medium Term Bond Programme of a maximum amount of €325 million.

Read more »

BOV CELEBRATES A CULTURE OF CUSTOMER-CENTRIC INNOVATION

October 23, 2025 | No comments

Bank of Valletta (BOV) proudly marked the conclusion of its fourth edition of CX Week 2025, a transformative week dedicated to elevating customer experience across the organisation. This year’s edition was defined by dynamic engagement, cross-functional collaboration, and a renewed commitment to placing customers at the heart of every decision.

Read more »