Eurozone periphery: An uneasy calm

HSBC Global Research: A focus on fundamentals

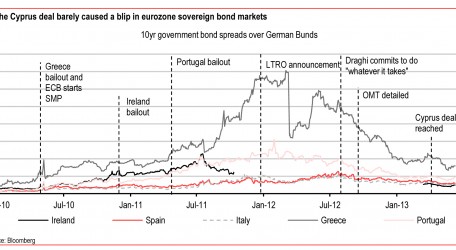

A sense of calm has pervaded the peripheral bond markets lately. Less than two months after capital controls had to be imposed on the newest member of the eurozone bailout club (Cyprus), sovereign yields in the periphery hit their lowest levels since winter 2010. However, the rise in global bond yields and volatility over the past month, which has also driven a rise in peripheral yields, reminds us that fundamentals could soon start to matter again. Currently the periphery’s are far from sound. Growth is still not coming back, unemployment rates are rising to socially unacceptable levels and debt projections continue to be revised up. This economic reality suggests financial markets may abruptly wake up from a somewhat complacent mood. The calm, such as it is, is an uneasy one.

This report updates progress in the bailout countries – Greece, Ireland and Portugal – comparing the original 2010 projections for austerity, growth and debt with the outturns so far. It also analyses Spain and Italy to assess the progress made. Italy is closer to debt-stabilisation but neither country is out of the woods. We also set out the next steps for the Cyprus programme and offer our thoughts on the challenges faced by Slovenia.

We conclude that the past year’s rally in government bond markets and the new, more nuanced approach to austerity will not succeed in stabilising government debt burdens in some peripheral countries any time soon. In the absence of a much stronger than expected pick-up in growth, there are three key risks for at least some eurozone member states: “Japanisation”; further debt restructurings of some kind; or debt mutualisation. More likely, there will be some combination of all three, posing policy challenges for politicians and the ECB.

Greece three years on: Debt mountain keeps growing

Three years on from the first Troika programme for a eurozone member state, the bond markets are in much better shape than they have been for most of that period. But yields are off their lows. Largely due to reasons which have very little to do with the eurozone, Spain and Ireland have already seen 10-yr yields rise by more than 50 bps while they have risen by much more in Portugal and Greece. Rates are still very low relative to where they have been over the past two years but higher rates have implications for debt sustainability. Seeing as the main goal of the various Troika programmes was to put these economies back on the path to debt-sustainability and to regain access to the bond market, the time seems right to take a closer look at whether the programmes are any closer to delivering the required macro-economic adjustment in the countries concerned.

This is particularly relevant for Greece, seeing as, under the terms of the first deal, it should now be coming to the end of it: the programme envisaged that real GDP would have started expanding last year, the government would by now be raising funds in the bond market and the debt stock would be peaking this year at just below 150% of GDP. The reality has been somewhat different. Rather than contracting by a cumulative 3.4% in the course of the programme, GDP has already contracted by 18.4% and is forecast, by the Troika to fall a further 4% or so in 2013. The debt burden is now assumed to peak at over 175% in 2013 but, even with the help of the 2012 sovereign debt restructuring, will still amount to nearly 160% by 2016 (see charts 3 to 5). Based on the latest review, the Troika no longer expects it to gain access to the bond market before 2016. Greece has been an extreme case and the IMF has just published a very detailed ex-post evaluation of the Greek programme, explaining why it had to bend its own rules to provide such a programme (e.g. the risks to the eurozone and the global economy). It admitted the assumptions of structural reform and growth were overly optimistic. That said Greece is by no means the only eurozone member state to overshoot its fiscal targets over the past three years.

- July 17, 2013 No comments Posted in: Business