Emerging market growth remains lacklustre

The HSBC Emerging Markets Index (EMI), a monthly indicator derived from the PMI™ surveys, remained only just above the neutral threshold of 50.0 in September, signalling muted output growth in global emerging markets. The EMI was little-changed at 50.8, from 50.7 in August, and the average for Q3 (50.3) was the lowest since Q1 2009 during the global financial crisis.

Growth rates for manufacturing output and services activity were marginal in September, although the goods-producing sector showed the best performance since May.

China registered only a modest rise in output in September, with manufacturing again weighing on overall growth. Meanwhile, India posted a third successive drop in activity and the fastest decline since March 2009, reflecting weakness in the service sector economy. Brazil and Russia both posted modest increases in business activity.

New business growth across emerging markets remained weak in September, and the level of outstanding business continued to fall. The level of employment across manufacturing and services stabilised, following a two-month period of job shedding.

Input prices increased at the fastest rate in seven months in September. That said, the pace of inflation remained weak in the context of the eight-year series average, mainly reflecting relatively weak price pressures in China.

Business expectations

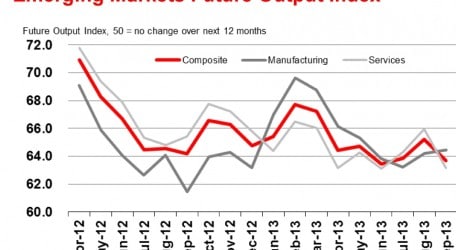

The HSBC Emerging Markets Future Output Index is a new series tracking firms’ expectations for activity in 12 months’ time. The index fell back in September and was only slightly above June’s record low in the 18-month history of the series. Output expectations moderated in the four largest emerging markets, with China posting the weakest sentiment followed by India, Russia and Brazil respectively.

Pablo Goldberg, the Global Head of Emerging Markets Research said,

“The September PMIs show economic conditions in emerging markets are showing marginal improvement, although the data remains disappointing overall.

“About half of the EM manufacturing PMIs are back above 50, with three quarters of the countries covered seeing improvements, compared to less than half a month ago.

“Most strikingly, headline PMI manufacturing is above 50 in China for the second month in a row, and the recovery in the developed world is continuing. These developments should help anchor economic activity in the rest of EM, in particular its export sector. In fact, new export order PMIs are showing some improvement in places like Mexico, the most open Asian economies, and CEEMEA.

“But the September HSBC PMI round also suggests that domestic economic conditions are still weakening in EM. The employment PMIs are mixed and the future output index for manufacturing outperforms that of services. Input prices appear to be on the rise, suggesting some impact from depreciating EM currencies, but there appears to be little pass through to the consumer, according to the output price PMIs. This should allow for monetary accommodation to prevail, in countries whose currencies are not under severe pressure, although the room for further easing is now quite limited.”

Regional tweets

www.twitter.com/HSBC_EMI_PMI

Simon Williams

HSBC Chief Economist, MENA

“Egypt’s still weak readings are disappointing, but growth in the Gulf is shrugging off political risk to go from strength to strength.”

Frederic Neumann

Co-Head of Asian Economic Research

“At last, Asia is getting a lift from the global industrial bounce. Indonesia and India, too, are looking up. China should stay the course.”

Andre Loes

HSBC Chief Economist, LATAM

“A lacklustre 3Q; manufacturing still contracting in Brazil, and barely stable in Mexico, while services remain expanding in Brazil, even if modestly.”

Murat Ulgen

HSBC Chief Economist, CEE & Sub-Saharan Africa

“CEE recovery is on track. While Turkey surprises to the upside, we expect slowdown from here due to tighter financial conditions.”

Manufacturing summary

Chinese manufacturing output expanded for the second successive month in September, though the rate of growth slowed to a fractional pace. Total growth of new work remained weak, but new export business increased for the first time in six months with panellists citing stronger demand from Europe and the US.

Business conditions in Taiwan’s manufacturing sector improved for the first time since April during September. Output, new orders and new export orders all increased for the first time in five months, and the rate of job creation was the fastest since April 2011. Meanwhile, output, new orders and purchasing activity at South Korean manufacturers were all virtually stable in September. This contrasted with recent falls and signalled a broad-based change of direction in the manufacturing economy.

Operating conditions across the Indian manufacturing sector deteriorated for the second consecutive month in September. However, both output and new orders contracted at slower rates. Still, faced with fewer projects, companies reduced their workforce numbers for the first time since February 2012.

The Indonesian Manufacturing PMI crawled above the neutral threshold in September, reflecting renewed growth of production. Whereas total new orders fell at a slower pace, the contraction of export business accelerated. Inflation of both input and output prices reached survey records. Meanwhile, September’s survey of Vietnamese manufacturers provided positive news on the health of the sector. New orders and employment both increased at survey-record rates, while there was a marked gain in foreign sales.

Following a two-month sequence of contraction, manufacturing production in Brazil rose in September. New orders and export business both fell at slower rates, leading firms to increase their buying activity. Mexico’s manufacturing sector stagnated in September, after having grown marginally one month previously. The level of output was the same as in August, linked to little-change in new orders.

September data showed an ongoing deterioration in Russian manufacturing business conditions, rounding off the weakest quarter since Q4 2009. New order growth slowed to a marginal rate as new export work declined for the first time in five months. Meanwhile, output rose at a fractional pace, and the rate of job shedding remained among the sharpest seen in four years.

A further solid increase in new orders continued to drive output growth in the Polish manufacturing sector in September. The rate of expansion in production remained strong, and firms expanded workforces at the fastest rate in over six years as a result. The manufacturing recovery in the Czech Republic also continued in September, with output growth maintained at a strong pace.

Turkish manufacturers reported sharp rises in output and new order intakes in September, with the rates of expansion accelerating to the quickest since January.

Middle East non-oil economy

Operating conditions in Saudi Arabia’s non-oil producing private sector improved in September. The rate of output growth accelerated to a five-month high and new order book volumes also rose at a faster pace, driven mainly by higher construction business, increased sales efforts and improved market conditions.

The UAE’s non-oil producing private sector companies reported a solid rise in activity in September, with the pace of expansion the highest in over two years. New order intakes increased at the fastest pace in the survey history and new export business also rose at an accelerated pace.

The latest survey results signalled further sharp declines in output and new orders at Egypt’s non-oil producing private sector companies. The rates of contraction eased, however, to the weakest in three months.

Business Expectations

Manufacturing output expectations remained brightest in South East Asia in September, with Indonesia and Vietnam registering stronger sentiment than all other economies surveyed. Meanwhile, goods producers in Central & Eastern Europe were more confident than those in the largest emerging economies such as China, India and Brazil.

In the Middle East non-oil private sector, Egypt registered a notable improvement in output expectations in September, with the respective index at the second-highest level in the 18-month series history. In contrast, the outlooks for activity in Saudi Arabia and the United Arab Emirates were each the lowest in 18 months of data collection for the future output series.

- October 16, 2013 No comments Posted in: Business